Your Money Deserves More

Commercial Real Estate Can Augment Your Investing Strategy

Adding passive income to your portfolio

Passive income is exactly what it sounds like: periodic disbursements without significant effort beyond your initial investment.

While real estate has traditionally been considered a passive investment strategy, actively owning rental properties generally requires considerable effort, including overseeing the purchase, performing inspections, finding tenants and ongoing property management and maintenance.

At envisionpropertiesgroup, our focus is on managing a diverse range of commercial real estate investments for our clients, covering properties located throughout the country. We handle all aspects of property management, offering our investors a truly passive and hassle-free real estate investing experience.

Steady monthly rental income makes real estate an ideal cash-flow investment

The potential production of steady monthly rental income makes real estate an ideal cash-flow investment.

$${totalPropertyValueFinancedAlt}BN

PROPERTY VALUE FINANCED VIA THE envisionpropertiesgroup PLATFORM

A strategy to grow value

A traditional growth strategy leverages investments that may increase in value over the long haul. For buy-and-hold real estate investors, this means investing in properties with potential for appreciation, with the intention of profiting at the time of sale. Additionally, ideal properties may even offer quarterly distributions over the course of ownership.

Comparisons are shown for illustrative purposes only and do not represent specific investments. Equities are represented by the total return of the Standard & Poor’s 500 Index (the “S&P 500 Index”) and the NAREIT Equity REITs Index, both of which are subject to market volatility risk. The S&P 500 Index is an unmanaged, capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries and is adjusted to reflect dividends paid. The NAREIT Equity REITs Index is an unmanaged, market-weighted index of publicly traded, tax-qualified REITs traded on the New York Stock Exchange, the American Stock Exchange, and the NASDAQ National Market System. The NAREIT Equity REITs Index reflects dividends paid. The S&P 500 Index and the NAREIT Equity REITs Index shown in this chart are meant to illustrate general market performance; it is not possible to invest directly in an index. The returns shown above are net of all fees and expenses. The performance of the indices has not been selected to represent an appropriate benchmark to compare to RM Income REIT or RM Apartment Growth REIT’s performance, but rather is disclosed to allow for comparison of RM Income REIT and RM Apartment Growth REIT’s performance to that of well-known and widely recognized indices. A summary of the investment guidelines for the indices presented are available upon request. Past performance is not a reliable indicator of future results.

Real estate can help achieve growth goals

With potentially lower volatility than the stock market and higher historic long-term gains, real estate investing can be attractive to growth investors. In select investments offered on the envisionpropertiesgroup platform, distributions can be reinvested to leverage the potential of compound interest.

Create a diversified portfolio

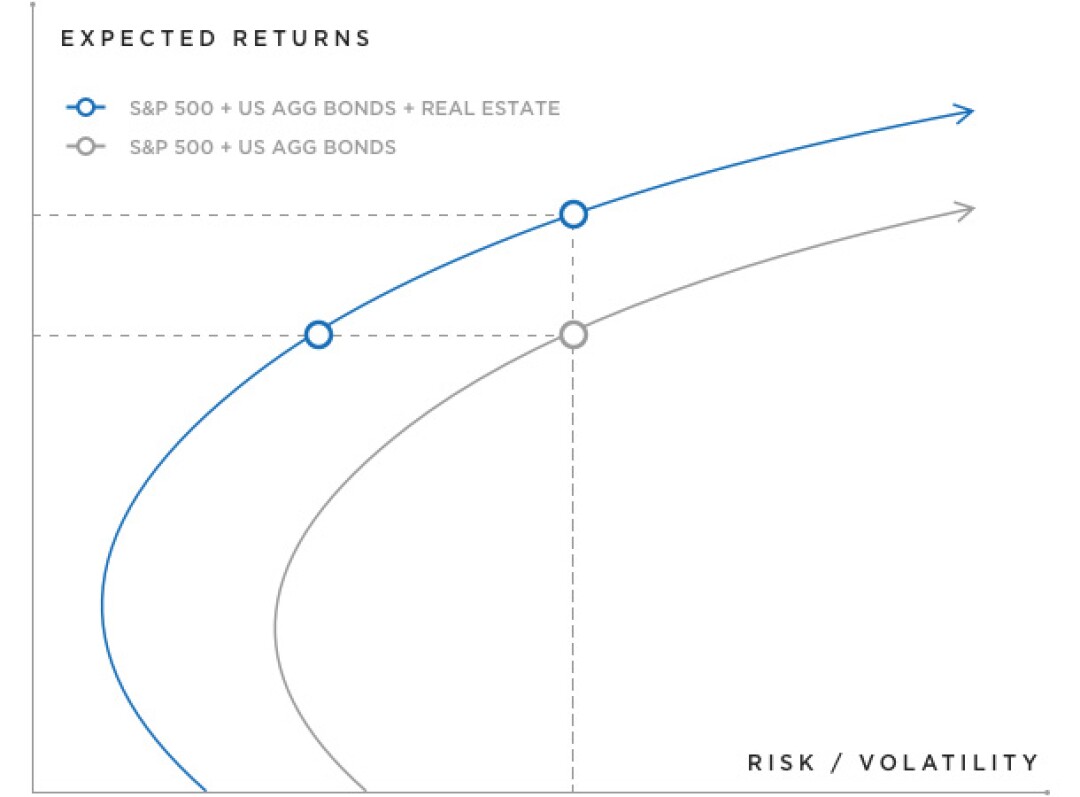

Many investors hold the notion that their portfolios are shielded from the fluctuations and volatility typical of public markets due to the inclusion of a variety of asset classes, such as stocks and bonds. This belief stems from the traditional investment strategy of diversification, which is aimed at reducing risk by spreading investments across different types of assets. However, this approach often overlooks the significance of incorporating primary alternative investments, of which real estate is a prime example.

Real estate, as an investment class, offers unique benefits that are not typically found in traditional stock and bond investments. It tends to have a low correlation with these markets, meaning it can behave differently under the same economic conditions. This characteristic of real estate can provide a stabilizing effect on an investment portfolio, especially during times of market turbulence or economic downturns.

EFFICIENT FRONTIER: TRADITIONAL INVESTMENTS WITH & WITHOUT ALTERNATIVES

Based on the returns of the S&P 500 Index, Barclays U.S. Aggregate Bond Index, and the NCREIF (National Council of Real Estate Investment Fiduciaries) Index, and with and without an asset allocation to direct real estate, over an 11-year time period (2006-2016).

Each index provides a broad representation of a particular asset class and is not indicative of any investment or a projection of performance. Asset allocation does not ensure a profit or protect against a loss. The rates of returns shown do not reflect the deduction of fees and expenses inherent in investing.

What does a diversified portfolio look like?

There are a variety of methods investors may use to determine their ideal portfolio allocation. But too often portfolios leave out an important asset class – commercial real estate. While the appropriate allocation of CRE will vary by investor based on their age, financial goals, or income, real estate is an important part of a diversified portfolio.